Understanding Residential Cash Flow Models is Critical

The importance of getting construction or specifically, re-construction or rehabilitation costs right cannot be overstated, it is vital to success. The quality and cost of rehab can continue to benefit or haunt the asset far past the initial completion of work. This is a truth for both local individual investors doing rehabs and the private equity companies aggregating for securitization. The reality is if you are a small Main Street investor or large Wall Street institution shoddy plumbing or other infrastructure work can result in significantly higher maintenance costs over time, and can also affect eventual exit pricing.

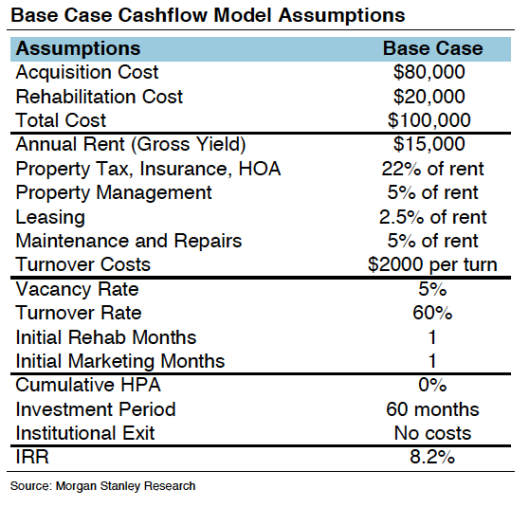

Morgan Stanley estimates that renovations will cost about 25% of the purchase price and provide an internal rate of return of about 8.2%. See cashflow model assumption below.

Many investors still feel that single-family rental properties are an “under-owned asset class” and that that investing in single-family homes and holding them as rentals for 10 years could produce double-digit investment returns, even if U.S. home prices only improved marginally. Other reason that their is so much momentum by both Main Street and Wall Street investors in single family hones is that America is becoming a Renter Society, with declining homeownership and rising demand for rentals.

- The single-family rental asset class is $3 trillion in value and completely fragmented

- Rents are rising and rental vacancy rates are falling across the country

- Hundreds of billions in distressed single-family assets are expected to come to market over the next 5 years

- Despite pockets of recovery, markets all over the country have surpluses of distressed single-family housing inventory

- The homeownership rate has fallen to 65.5% from a high of 69.2%. The effective rate (not including delinquent borrowers) is already below 60%

Buyers Utopia works with both individual investors and private equity firms on the acquisition and disposition of investment grade residential properties. [iphorm_popup id=”1″ name=”Contact Form”] Contact Us [/iphorm_popup]

Leave a Reply

You must be logged in to post a comment.